29 Jul Wedding Insurance

Wedding Insurance for Valley Weddings and Special Events importance

Wedding Insurance and wedding event insurance. A wedding is a joyous and momentous occasion, filled with love, excitement, and the promise of a beautiful future together. However, as with any significant event, weddings come with a level of risk. From unexpected weather conditions to vendor mishaps, there are various factors that could potentially disrupt the carefully planned celebration. That’s where wedding insurance steps in as a crucial safety net. Providing financial protection and peace of mind for couples planning their Valley weddings or any other special event.

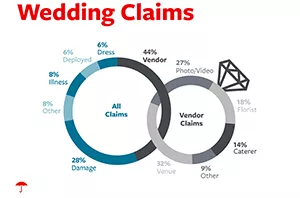

First and foremost, wedding insurance is a specialized type of event insurance that covers unforeseen circumstances. Also protects the financial investment made into the wedding. In addition, it typically comes in two main types: liability insurance and cancellation/postponement insurance.

- On one hand, liability insurance protects the couple from financial liability in case of accidents or injuries that occur during the event. On the other hand, for example, if a guest were to trip and fall during the reception and decide to pursue legal action. Liability insurance would help cover the legal expenses and potential settlements.

- Meanwhile, cancellation/ postponement insurance is designed to safeguard against losses incurred due to unforeseen circumstances. That could force the wedding to be canceled or postponed. For instance, such circumstances may include extreme weather, vendor bankruptcy, serious illness, military deployment, or even a family emergency.

Considering the specific context of Valley weddings, Valley weddings, particularly those in the picturesque Rio Grande Valley, often take place in outdoor settings, showcasing the region’s natural beauty. Therefore, wedding insurance can prove to be especially valuable for these events, offering protection against weather-related damages and additional expenses.

Furthermore, many couples invest a significant portion of their savings into their dream wedding, hiring vendors, booking venues, and purchasing various services. Consequently, a sudden vendor bankruptcy or no-show could lead to substantial financial losses. Hence, wedding insurance helps mitigate such risks, offering reimbursement for deposits and additional expenses incurred due to vendor issues.

Additionally, life is unpredictable, and unfortunate situations can arise unexpectedly. Thus, in the case of Valley weddings or any special event, having it can provide financial protection if the unforeseen occurs. For example, whether it’s a sudden illness that prevents the couple from tying the knot as planned or a natural disaster that forces the event to be postponed. Wedding insurance can offer coverage for non-refundable expenses, allowing the couple to reschedule without incurring additional costs.

In conclusion, wedding insurance is a valuable investment for Valley weddings and any other special events. To sum up, it offers financial protection and peace of mind. Ensuring that the couple can focus on celebrating their love without the constant worry of unforeseen circumstances derailing their plans. In summary, by selecting the right wedding insurance policy, couples can safeguard their investment and create lasting memories of a perfect and stress-free wedding day.

Where to go on your honeymoon, ideas are here